For business owners, paying non-essential professional fees is nearly as unpalatable as paying unnecessary taxes. If you are convinced that you don’t require the services of a certified valuation analyst to value your company, this will not be your favorite issue of this newsletter. This issue (and an open mind) may, however, help you avoid an unpleasant encounter with the IRS and help you to reap all of the value of your life’s work.

Read MoreCategory Archives: Grow and Protect Your Business

Cash Flow Forecasting: The Ultimate Reality Check

Why is cash flow is so important to third party buyers, and by extension, to sellers of closely held companies? In short, a seller must demonstrate an increasing stream of cash flow from the business. Without a healthy cash flow, a buyer may pass over the opportunity to buy your business in favor of purchasing a “good” company with less risk.

Read MoreWhat Is Your Business Really Worth?

For many owners, the answer to one question determines their ability to leave their companies: “How much money will I get when I sell?”

This question is indeed critical, and answering it is the second step of The Seven Step Exit Planning Process™. Realistically, you can’t exit your business unless you achieve financial independence, and the primary source of that independence is likely to be the funds you receive for your business when you leave.

Let’s look at fictional owner Ron Nee, the owner of Landscaping Supply Company, to see why a valuation—well before your exit date—is so important.

Read MoreThe Importance of Shifting Core Duties Prior to Your Exit

To illustrate the importance of shifting core duties prior to your exit, let’s introduce Will Tryon, our hypothetical business owner of a thriving pre-cast manufacturing company. When Will began thinking about who he should transfer management responsibilities to and which responsibilities should be transferred first, he quickly became overwhelmed because the degree of responsibilities he held as the company’s owner were complex and ingrained in his everyday routine.

Read MoreA Preliminary Financial Needs Analysis

In the previous issue of The Exit Planning Review™, we learned that there are five elements that must be determined before any owner (or professional advisor) can begin to create a successful Exit Plan. These elements are:

The owner’s Target Departure Date

A preliminary financial needs analysis

The owner’s desired successor

A preliminary valuation of the company

An estimate of future company cash flow

Buy/ Sell Agreement Series: Part 3- Is Your Buy-Sell Agreement Current?

The business continuity agreement is the single most important document that the owners of a closely held business will ever sign. This agreement (also known as a buy-and-sell or buy-sell agreement) controls the transfer of ownership when certain events occur. These events include: the death or disability of a shareholder, an involuntary termination or retirement of a shareholder and even (yes they do happen) disputes among owners.

Read MoreBuy/Sell Agreement Series: Part 2- Yes, You Really Do Need One

In the last issue of this newsletter, we presented a number of reasons why a business continuity (or buy/sell) agreement can be one of the single most important documents that you, as a closely held business owner, will sign.

Read MoreBuy/Sell Agreement Series: Part 1- Do You Really Need A Buy/ Sell Agreement?

In our last issue of this Newsletter, we discussed the problems that can arise if a business continuity (buy/sell) agreement designed for one event (usually the death of a shareholder) is called upon to manage the more likely event of a shareholder’s departure during his or her lifetime. Lifetime departures may occur due to the retirement, termination, divorce or bankruptcy of an owner.While it is true that poor design or failure to update the agreement—especially in tough economic times—can create significant problems, does that mean you and your co-owners shouldn’t have one in place?In a word, NO! The business continuity agreement may be one of the most important documents that you, as a co-owner of a closely held business, will ever sign. For an idea of why, consider the case of Acme, a fictional company.George Acme’s son-in-law, Tom Gardner, had worked for George for over 20 years. Tom had gradually assumed operational management and was the acting CEO. In recognition of Tom’s contribution, George had sold Tom—mostly at a low value—25 percent of the company.Everyone expected that Tom would one day own Acme, Inc. But before that day arrived, George died and Tom’s sister-in-law became the executor of George’s estate. […]

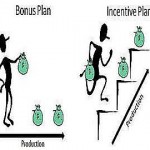

Read MoreCharacteristics For Your Bonus Incentive Plans

Too often, owners only discover that the compensation plans they’ve put in place for key employees are sadly inadequate when those key employees leave their companies for greener pastures. The departure of one or more of these key employees not only complicates your daily business life, but it can slam shut the door on your exit plans. Without experienced management in place, you may find it very difficult (if not impossible) to leave your business in style.

Read MoreSet Your Exit Objectives… Even If You Are Not Ready To Exit

Remember Peter Daniels, our perennial procrastinator?

In 2005 Peter Daniels wanted to leave his food processing plant in five years by selling it for enough cash to maintain a comfortable lifestyle. A quick review of the company’s financials suggested that with a current annual cash flow of $250,000, before his salary of $250,000, the company would be valued around $1 million. Peter’s advisor suggested creating and implementing a step-by-step roadmap to increase value, minimize taxes, and protect existing value from loss, and Peter agreed, but did nothing more. Peter never designed an exit plan nor did he ever implement one.

Read MoreTransition Planning: Exit Your Business… But Don’t Leave it!

“Exiting” is not black and white: Stay involved in the business and have a liquidity event to develop the cash you need.

Transition Planning guides you to orchestrate a successful, permanent exit or to forge a path toward an exit without giving up ownership. Or both.

Failure to Plan Has a Price

“Exiting” is not black and white: Stay involved in the business and have a liquidity event to develop the cash you need.

Transition Planning guides you to orchestrate a successful, permanent exit or to forge a path toward an exit without giving up ownership. Or both.

Knowing Business Value is a Very Good Place to Start

People don’t want to spend money on things they don’t need. So why would you need an estimate of your company’s value if you don’t expect to leave for several or many years? You may not if you fall into one of two groups:Owners who are sure that their business exits are more than 10 years away.Owners who are certain that the value of their companies is miniscule compared to what they will need upon sale or transfer.However, many owners look to the value of their businesses as the chief source of liquidity for their post-exit lives. Owners intend to leave as soon as is feasible rather than when they are completely burned-out. Therefore, most owners need to know the value of their companies now so they can be smart about creating greater business value as quickly as possible.Knowing the value of your business today is critical, whether you plan to leave your business tomorrow or in five years, for the following five reasons: An estimate of value establishes the starting line and distance to the finish.An estimate of value tells owners where their unique race to their exits begins. The owner’s job, whether the company is worth $500,000 or […]

Read More3 Universal Requirements for a Successful Family-Business Transfer

When we advisors think of family-business transfers, we tend to focus on family-specific challenges. Of course, some challenges are common to all successful owner exits. In this article we briefly look at three of these universal challenges, but from a family-business transfer perspective: 1) a capable successor, 2) a prepared business and 3) a ready owner.

Read MoreThe Lifetime Stay Bonus

You’ve decided to sell your company to an outside party. For a number of reasons, it is critical to keep your employees on board as you leave.Key employees’ efforts to maintain cash flow are critical to maximizing the eventual sale price of the business.They may need to shoulder extra duties as your attention may wane or become diverted to your future retirement plans.Most importantly, third-party buyers are unlikely to buy your company without the continued presence of your key employees.So, how do you ensure that your key employees will remain at their posts, even as you prepare to leave yours? One short-term incentive plan that can be set up to meet your employee incentive Exit Plan objectives is the Lifetime Stay Bonus. The Lifetime Stay Bonus not only provides recognizable incentives for your key employees to stay on board and help your business through the transition period, but they also provide a level of stability and certainty for your company and its employees to succeed.In our experience, selling owners typically have three objectives with respect to their key employees:To motivate key employees to increase the company’s cash flow in the period leading up to the sale.To keep key employees on board before, during and after […]

Read MoreSelect the Right Exit Path Series- Part 3: Selling to Third Party

As discussed in the previous issue of Grow and Protect Your Business, it is important to select your successor early in the Exit Planning Process. In the past two issues, we have discussed the advantages and disadvantages of transferring ownership to children and selling to other owners or employees. The last scenario that we will look at during this Exit Planning Review™ series of articles is the sale to a third party. The market has indicated that 20 percent of businesses are for sale to a third party, but only one out of four actually sells. For businesses above $10 million per year; however, the odds improve to 50 percent.1 In a retirement situation, a sale to a third party too often becomes a bargain sale – most often the only alternative to liquidation. This option becomes necessary in many situations because owners fail to create a market for their stock through sale to family members, co-owners or employees. The following are advantages to selling your business to a third party, as well the disadvantages associated with this type of exit plan. It is important to compare the advantages and disadvantages of this type of transfer scenario when choosing your […]

Read MoreSelect the Right Exit Path Series- Part 2: Transferring Ownership to Children

As discussed in the previous issue of The Exit Planning Review™, the purpose of Exit Planning is for you to achieve your financial and lifestyle objectives after you leave your business. One of the fundamental objectives that needs to be decided early in the Exit Planning Process is selecting your successor.

Read MoreWhat To Expect From A Buyer

Assuming that all business owners (except for those forced to liquidate) will eventually sell or transfer their companies, we often focus on what it takes to be a well-prepared seller. Setting exit objectives, planning to minimize the income taxes on the ownership transfer, building business value and selecting a skilled Team of Advisors are some of the most important items on any “Savvy Seller Checklist.”

Read MoreChildren Series: Part 4- How Can I Provide for an Equitable Distribution of My Estate Among My Children?

Parents normally want to give equal amounts of their estates to their surviving children, regardless of how active each child is in the business. The problem with including this provision in a will is that each child may get not only an equal amount of the business, but also an equal amount of the non-business assets.

Read MoreChildren Series: Part 3- Leveraging the Stock Bonus Plan

A business owner who is primarily concerned with transferring ownership with minimal tax consequences and who has sufficient personal financial resources so that receiving payment for the ownership interest being transferred is not essential may be able to efficiently transfer ownership using a stock bonus. This technique can offer some interesting tax and other advantages.

Read MoreChildren Series: Part 2- “Oldco/Newco” Technique for Family Business Transfers

The most common use of the “Oldco/Newco” concept is in family business transfers. In the family run business scenario, “Oldco/Newco” may work well if the situation does not lend itself to gifting, either outright or indirectly, by using a Grantor Retained Annuity Trust (GRAT). GRATs do not work effectively to transfer ownership interests when there is substantial value, but the business is not growing in value or does not have significant income. Lifetime gifting without using some type of a split interest trust, such as a GRAT or an Intentionally Defective Grantor Trust (IDGT), can quickly exhaust available gift tax exemptions and create unwanted taxation.

Read MoreSelling to Insiders Series: Part 1- Elements of the Plan

Today we discuss the essential elements of a plan owners use to transfer a business to insiders (with the help of skilled advisors) that keeps the owner in control until he or she is paid the sale price. If you suspect that the children, key employees or co-owners you would pick to succeed you do not have the funds to cash you out, consider the following 10 elements that make insider transfers successful.Element 1: Time.A transfer to insiders takes time: time to plan, time to implement and to pay the departing owner. Typically the more time owners take to transfer the company, the less risk they incur and more money they receive from the new owners.For that reason, the first question an owner must answer is: Am I willing to take time (typically three to eight years) to execute and complete an insider transfer (while maintaining control)? If the answer is no, then it is probably best to consider other exit paths.Element 2: Defined Owner Objectives.If owners are willing to devote the time necessary for this exit strategy, they also must define and or quantify their objectives. These may include:• Financial security and independence;• Departure/retirement by a chosen date;• Keeping […]

Read MoreSix Estate Planning Questions for Business Owners

James Keefe sat nervously in his Exit Planning Advisor’s office. Until the day before, he had been president of Keefe Automotive Sales, one of the region’s largest new car dealerships. Now he was out of a job and felt he was a victim. Naturally, his first thought was to sue those responsible for his misfortune. The targets of his wrath were his younger sister and his mother. They had forced him out of the business.

Read MoreKey Employees Series: Part 3- Phantom Stock Plan: The Stock Plan That Isn’t

When an owner decides to financially motivate a key employee (or management in general), his first question should be, “Can this employee increase the value of my business in a measurable way?”If the employee in question is a sales manager and the answer yes, then the owner designs an incentive plan to motivate the sales manager to behave in a way that fosters an increase in business value. This may seem elemental, but it is not. Too often we see stock awarded to a sales manager when a cash-based plan directed at increasing sales is not only more effective but also more appreciated.Let’s look at how one owner solved the problem of matching the incentive to his desired result.During an annual performance review, Tom Sugar’s Chief Operating Officer expressed an interest in owning part of the company. Tom was really not interested in taking on a co-owner because he eventually wanted to transfer his company to his daughter. He didn’t want to sell or bonus stock but he didn’t want to lose his key employee. Tom was at an impasse. His CPA had told him that it rarely made sense to mix ownership among family and employees. On the other hand, Tom’s COO wanted […]

Read MoreKey Employees Series: Part 2- Incentive Plans

Experts and laymen agree that one constant of successful companies is a stable, motivated management team. This quality not only contributes to corporate success, it is also key to the business owner’s successful business exit.Should you decide to sell your business to a third party, you’ll discover that potential buyers place significant value on the strength of your management team—if that management team can be expected to remain after you have left the business. Similarly, if you contemplate selling the business to family (or to employees), the likelihood of being paid for the business after you’ve left can be entirely dependent on the strength of your remaining management team.In short, capable management remaining with the company can be the key to getting top dollar for your business. Without such management your exit may be more difficult.One of the many factors involved in creating, motivating and keeping good management is the creation of a properly designed incentive plan for key employees. To be successful, an incentive plan must motivate the management team to increase the value of the company in a measurable way. Only by increasing company value do employees receive the incentive (ownership or cash).Successful plans share four basic elements:First, the plan […]

Read More